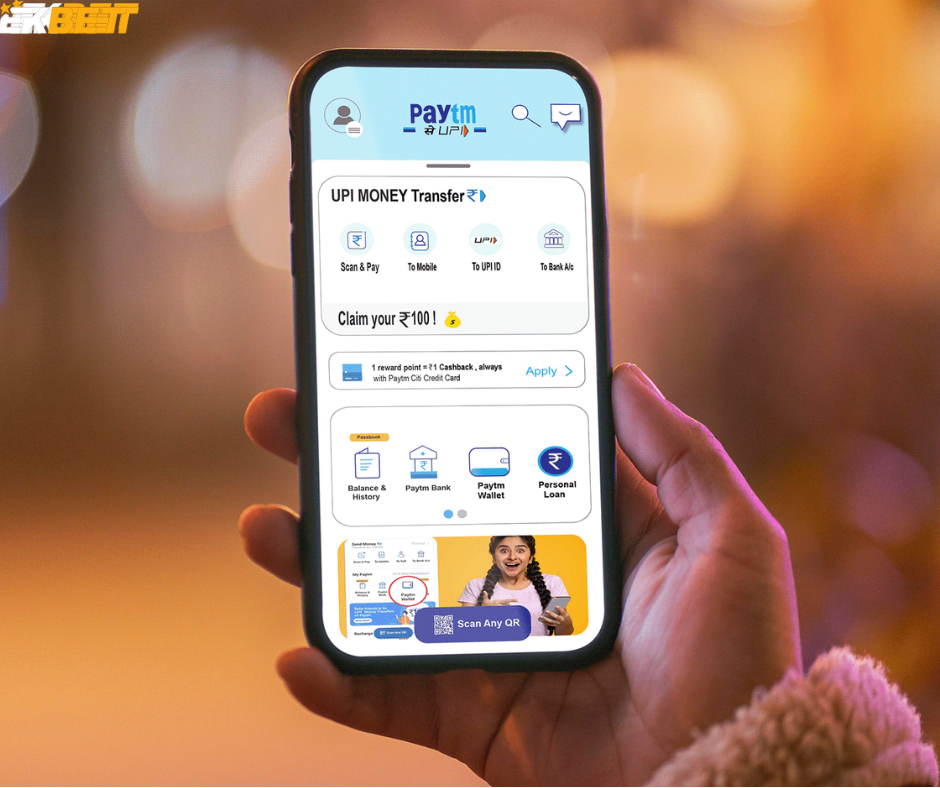

Paytm has become a must-have for many Indians, providing an easy and handy way to handle their money and transactions. Are you making the most of Paytm? It’s the go-to app for millions across India, offering easy ways to handle money matters. But did you know there are smart tricks to get even more out of it?

Introduction of Paytm

In recent years, has emerged as one of the most widely used digital payment platforms in India, revolutionizing the way people transact in the country. Founded in 2010 by Vijay Shekhar Sharma, initially started as a mobile recharge and bill payment platform but quickly expanded its services to become a comprehensive financial services provider. Today offers a wide range of services, including mobile recharges, bill payments, online shopping, ticket bookings, and even banking services through Payments Bank.

In this article, we will delve into the world of Paytm and explore ten genius hacks that every Indian should know. These hacks are designed to help you make the most out of your experience, whether it’s earning cashback on transactions, managing your Paytm wallet effectively, or utilizing for various financial needs. So, let’s embark on this journey to unlock the secrets of maximizing your benefits with Paytm!

1. Setting Up Your Paytm Account

- Downloading Paytm: Learn how to get the Paytm app on your phone, step by step.

- Secure Passwords: Discover tips to make a strong password for your account and keep it safe.

- Linking Your Bank Account: Find out why it’s important to connect to your bank account and how to do it.

- KYC Verification: Understand what KYC verification is and why it’s necessary for your account.

2. How Paytm offers Cashback on Various Transactions

Paytm’s cashback system works like magic, turning everyday transactions into opportunities to earn money back. When you make a purchase or perform a transaction, whether it’s paying bills, recharging your phone, or even shopping online, rewards you with cashback. This cashback can vary in amount, depending on the offer or promotion available at the time.

Essentially, Paytm partners with various merchants and service providers to offer cashback incentives to its users. These partnerships allow Paytm to pass on a portion of the transaction value back to the user in the form of cashback. It’s a win-win situation – you get rewarded for using Paytm, and merchants benefit from increased customer loyalty and engagement.

3. Tips for Maximizing Cashback Earnings on Everyday Purchases.

Here are some tips to get the most cashback on your regular purchases:

- Keep an eye out for special cashback offers: Paytm frequently announces new deals and promotions, so check the app regularly to see what’s available.

- Use Paytm for all your payments: Whether it’s groceries, utilities, or online shopping, try to use Paytm whenever possible to earn cashback on your transactions.

- Combine offers: Sometimes, offers cashback on specific categories or merchants. Try to stack these offers with other discounts or deals for maximum savings.

- Pay attention to terms and conditions: Make sure you meet all the requirements for earning cashback, such as minimum transaction amounts or specific payment methods.

- Refer friends: Many apps offer referral bonuses for inviting friends to join. Take advantage of these bonuses to earn extra cashback.

By following these tips, you can make the most of cashback offers and save money on your everyday purchases.

4. Using Paytm for Bill Payments

- One-stop platform: With Paytm, you can pay all your bills in one place, whether it’s electricity, water, gas, or even mobile and broadband bills. This saves you the hassle of managing multiple accounts and remembering different due dates.

- Easy and fast payments: Paytm’s user-friendly interface allows you to pay bills quickly and effortlessly. Just a few taps on your phone, and your payment is done. No need to stand in long queues or visit multiple offices.

- Reminders and notifications: sends timely reminders for bill payments, helping you stay on top of your finances and avoid late fees or service interruptions. You can also set up auto-payments for recurring bills, saving you time and effort.

- Secure transactions: ensures the security of your transactions with advanced encryption technology and secure payment gateways. Your sensitive financial information is kept safe from unauthorized access.

- Cashback and rewards: often offers cashback and rewards for bill payments, giving you extra savings every time you pay your bills through the app. This adds an extra incentive to use Paytm for your financial transactions.

Overall, using Paytm for bill payments is convenient, secure, and rewarding, making it the preferred choice for millions of users across India.

5. Step-by-step guide to easy pay bills using Paytm:

- Download and Install Paytm App: Start by downloading the Paytm app from the Google Play Store or Apple App Store. Install the app on your smartphone and sign up for an account if you haven’t already.

- Login to Your Paytm Account: Open the Paytm app and log in using your registered mobile number and password.

- Navigate to Bill Payments: Once logged in, you’ll see various options on the home screen. Tap on the “Pay” icon at the bottom of the screen, then select the “Recharge & Pay Bills” option.

- Select the Type of Bill: Choose the category of the bill you want to pay. It could be electricity, water, gas, broadband, mobile postpaid, or any other utility bill.

- Enter Bill Details: Enter the required details such as your customer ID, account number, or registered mobile number associated with the bill. Make sure to double-check the information to avoid errors.

- Enter Payment Amount: After entering the bill details, enter the amount you wish to pay. Paytm may also display the outstanding bill amount if available.

- Choose Payment Method: Select your preferred payment method from options like Paytm wallet, linked bank account, debit card, credit card, or UPI.

- Apply Promocode (if applicable): If you have any applicable promocodes or cashback offers, apply them to avail discounts or cashback on your bill payment.

- Review and Confirm: Review the payment details, including the biller name, payment amount, and payment method. Once you’re satisfied, tap on the “Proceed to Pay” button.

- Authenticate Payment: Depending on your chosen payment method, you may need to authenticate the transaction using OTP (One-Time Password) or biometric verification.

- Payment Confirmation: After successful payment, you’ll receive a confirmation message on the app as well as via SMS or email. You can also view the payment receipt in the app for your records.

- Save Biller for Future Payments (Optional): If you frequently pay bills to the same service provider, you can save the biller details for future transactions to streamline the process further.

Following these steps will ensure a seamless experience when paying bills using the Paytm app.

6. Advantages of Recharging Prepaid Services Through Paytm

Recharging prepaid services through Paytm offers several advantages:

- Convenience: Paytm provides a one-stop platform for recharging prepaid services, including mobile phone recharges, DTH (Direct-To-Home) services, and metro card top-ups. Users can recharge their services anytime, anywhere, using the Paytm app or website, eliminating the need to visit physical stores or outlets.

- Wide Range of Services: Paytm supports recharges for various telecom operators, including Airtel, Jio, Vodafone Idea, and BSNL, among others. Additionally, users can recharge DTH services such as Tata Sky, Dish TV, and Videocon D2H, as well as metro cards for transportation services in select cities.

- Multiple Payment Options: Paytm offers flexible payment options for recharges, including wallet balance, debit cards, credit cards, net banking, and UPI (Unified Payments Interface). This allows users to choose their preferred payment method for added convenience and flexibility.

- Instant Recharge: Recharging prepaid services through is quick and hassle-free. Once the payment is made, the recharge is processed instantly, and users receive confirmation of the recharge on their mobile phones or via email. There’s no waiting time or delay in reactivating services.

- Exclusive Offers and Cashback: Often runs special promotions and cashback offers for prepaid recharges, providing users with additional savings and benefits. Users can avail of discounts, cashback, and other rewards when recharging through making it a cost-effective option.

- Transaction History and Records: Maintains a detailed transaction history for recharges made through the platform, allowing users to track their recharge activity over time. This feature enables users to monitor their spending, stay organized, and easily access recharge receipts for reference purposes.

7. Discuss Different Investment Options Available on Paytm

Offers various investment options to cater to the diverse financial goals and risk appetites of its users. Here are some of the investment avenues available on Paytm:

- Mutual Funds: Provides a platform for investing in mutual funds from leading Asset Management Companies (AMCs). Users can choose from a wide range of mutual fund schemes, including equity funds, debt funds, hybrid funds, and more also offers features like SIP (Systematic Investment Plan) for disciplined investing and portfolio tracking tools for monitoring investments.

- Digital Gold: Allows users to invest in digital gold, providing a convenient and cost-effective way to buy and sell gold online. Users can purchase gold in small denominations, starting from as low as ₹1, and store it securely in Paytm’s vaults. The digital gold can be converted into physical gold or redeemed for cash at any time.

- National Pension System (NPS): Offers the option to invest in the National Pension System (NPS), a government-sponsored retirement savings scheme. Users can open an NPS account through and make contributions towards building a retirement corpus. NPS offers tax benefits under Section 80C and allows users to choose their asset allocation based on risk preference.

- Equity Trading: Also provides a platform for equity trading, allowing users to invest in stocks listed on Indian stock exchanges such as BSE and NSE. Users can buy and sell stocks in real-time, track market movements, and access research and analysis tools to make informed investment decisions.

- Fixed Deposits: Offers the option to invest in fixed deposits (FDs) from leading banks and financial institutions. Users can choose from a range of FD tenures and interest rates to suit their investment horizon and risk profile. Also facilitates the seamless opening and management of FD accounts through its platform.

- Exchange-Traded Funds (ETFs): Allows users to invest in exchange-traded funds (ETFs), which are investment funds traded on stock exchanges similar to stocks. ETFs offer diversification across a basket of securities and are suitable for investors seeking exposure to specific asset classes or market indices.

8. Tips for Getting the Best Deals on Travel Bookings via Paytm

Here are some insider tips for getting the best deals on travel bookings via Paytm:

- Keep an Eye on Promotions: frequently offers special promotions and discounts on travel bookings. Keep a lookout for these promotions on the app or website, as they can provide significant savings on flights, hotels, and other travel services.

- Compare Prices: Before making a booking, compare prices across different travel providers and platforms. Use search and comparison tools to find the best deals on flights, hotels, and holiday packages.

- Use Cashback Offers: Often runs cashback offers on travel bookings, where you can earn cashback in your wallet for making a booking. Look out for these cashback offers and take advantage of them to save money on your travel expenses.

- Book in Advance: Planning your travel well in advance can help you secure better deals and lower prices. Try to book your flights and hotels early to take advantage of early bird discounts and promotional fares.

- Flexibility is Key: Stay flexible with your travel dates and destinations to find the best deals. Consider traveling during off-peak seasons or mid-week days when prices are typically lower. Flexibility with your travel plans can help you score better deals.

- Bundle and Save: Consider bundling your travel services, such as booking flights and hotels together as a package. Often offers discounts and special deals for bundled bookings, allowing you to save money compared to booking each service separately.

- Use Paytm Travel Vouchers: Occasionally offers travel vouchers or discount codes that can be applied during the booking process. Keep an eye out for these vouchers and redeem them to unlock additional savings on your travel bookings.

- Subscribe to Alerts: Subscribe to email alerts or notifications to stay informed about the latest travel deals and offers. You’ll receive updates on new promotions, flash sales, and exclusive discounts, ensuring you never miss out on a great deal.

9. Advantage of Special Offers to Maximize Savings

Take advantage of special offers to maximize your savings on! Whether it’s cashback promotions, discount codes, or exclusive deals, offers plenty of opportunities to save money on your purchases. By keeping an eye out for these special offers and taking advantage of them whenever possible, you can stretch your rupee further and get more value for your money. So, don’t miss out – check the app regularly, subscribe to notifications, and be ready to pounce on those irresistible deals. Your wallet will thank you!

10. How Paytm Can Benefit Small Businesses and Entrepreneurs

Offers valuable tools and services for small businesses and entrepreneurs:

- Payment Solutions: Easily accept digital payments through QR codes, POS devices, and online gateways.

- Inventory Management: Streamline stock tracking and order fulfillment for efficient operations.

- Customer Engagement: Engage customers with personalized offers and loyalty programs to drive sales.

- Financial Services: Access business loans, insurance, and banking solutions for growth and stability.

- Marketing and Advertising: Reach a wider audience through targeted advertising campaigns on platform.

- Data Analytics: Gain insights into customer behavior and market trends to make informed business decisions.

CONCLUSION:

Offers a comprehensive suite of tools and services designed to empower small businesses and entrepreneurs. From seamless payment solutions and efficient inventory management to targeted customer engagement and valuable financial services equips businesses with the resources they need to succeed in today’s competitive marketplace.

Ready to take your business to the next level? Sign up and start reaping the benefits of our tailored solutions. Empower your business and embark on a journey towards greater success.

FAQs About PayTM

1. What is Paytm?

- Is a leading digital payments platform that offers a wide range of services, including mobile recharges, bill payments, online shopping, and financial products.

2. How do I download the Paytm app?

- You can download the app from the Google Play Store for Android devices or the Apple App Store for iOS devices. Simply search for “Paytm” and follow the prompts to download and install the app.

3. Is it safe to use Paytm for transactions?

- Yes, employs state-of-the-art security measures to ensure the safety and security of your transactions. Your personal and financial information is encrypted and protected at all times.

4. Can I use Paytm to send money to friends and family?

- Yes, allows you to send money to friends and family instantly using the “Send Money” feature. Simply enter the recipient’s mobile number or ID, enter the amount, and confirm the transaction.

5. How do I add money to my Paytm wallet?

- You can add money to your wallet using various payment methods such as debit cards, credit cards, net banking, and UPI. Simply navigate to the “Add Money” section in the app, enter the amount, and choose your preferred payment method.

6. What kind of services can I pay for using Paytm?

- Paytm allows you to pay for a wide range of services, including mobile recharges, bill payments (electricity, water, gas, etc.), DTH recharges, online shopping, and more.

7. How do I avail cashback offers on Paytm?

- To avail cashback offer simply check the “Offers” section in the app for the latest deals and promotions. Make sure to fulfill the terms and conditions of the offer while making your transaction to qualify for the cashback.

8. Can I book travel tickets and hotels through Paytm?

- Yes, offers a travel booking platform where you can book flights, trains, buses, and hotels. You can also avail of special deals and discounts on travel bookings .

9. How do I contact Paytm customer support for assistance?

- You can contact customer support through the app or website by navigating to the “Help & Support” section. You can also reach out to via email, phone, or social media channels for assistance.

10. Does Paytm offer financial products like loans and insurance?

- Yes, offers a range of financial products and services, including loans, insurance, wealth management, and more. You can explore these services in the “Financial Services” section of the app.

HOME | REGISTER | FACEBOOK | INSTAGRAM | DOWNLOAD APP | EKBET.COM | NEW SITE